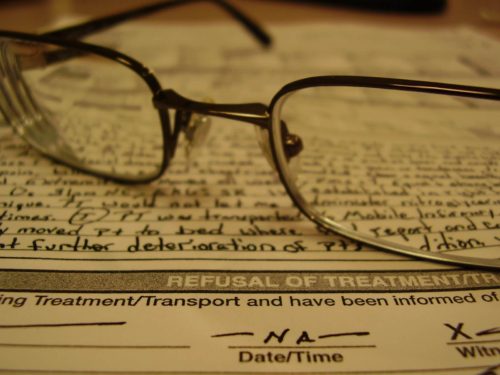

A deed must be notarized as well as filed in the public records; it may additionally need to be seen by a witness with the mobile notary present. The person who will authorize the action (the individual who is transferring the residential or commercial property) should take the deed to a notary public, who will view and authorize the document as well as mark it. The registration suggests that a notary public has actually verified that the signature on the action is authentic.

In some states, deeds have to additionally be authorized by witnesses that watch the proprietor authorize the act.

The individual who authorized the action must “tape” (file) the deed with its notarized signature in the land records workplace in the area where the home is located. This office goes by different names in different states; it’s generally called the Region Recorder’s Office, Land Computer Registry Office, or Register of Deeds. In the majority of counties it’s located in the court house.

Recording a deed is simple: Just take the signed, original document to the land documents workplace. The staff will take the deed stamp it with the date as well as some numbers then make a copy and give the original back to you. The data is usually made public, which shows where the deed is located in the county’s declaring system. There will most likely be a small fee, possibly no more than $15 a page for recording.

A deed of trust as it is called isn’t like other types of actions; it is not used for the transfer of a home. It’s truly just a variation of a home mortgage, generally made use of in some states (California, for example). A trust fund deed transfers title to land to a “trustee,” typically a trust or title business, which holds the land as safety for a loan. When the loan is paid off, the title is transferred to the consumer. The trustee has no powers unless the customer defaults on the funding. After that the trustee can offer the home and also pay the loan provider back from the proceeds, without litigating.

A contract for deed is not actually an action. Likewise known as a “contract of sale,” “land sale contract,” or “installment sales agreement,” it’s utilized when a financial vendor resources a residential property for a buyer. The agreement mentions that the seller will maintain the title to the residential or commercial property until the buyer repays the loan.

What is a transfer-on-death deed?

These deeds, typically called TOD or beneficiary acts, are like regular deeds with the exception of one extremely vital difference: They don’t take effect until after your death. They’re utilized to leave real estate without probate court proceedings.

Using a TOD act prevents probate since after your death, the beneficiary named on the deed takes possession of the residential property immediately. There’s no probate paperwork or delay.

Filling out a TOD act, which clearly specifies that it doesn’t take effect until after your death, is like filling out a regular deed. You call the recipient, authorize the deed, get it notarized, and also data (document) it with your regional property documents workplace.

TOD acts are presently admitted in 23 states: Arizona, Arkansas, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Virginia, Washington, Wisconsin, and also Wyoming.

Be sure to make use of a deed type that contains all the elements needed by your state.